US Weekly - 06.11.2023

The US Weekly summarizes funding rounds across the United States from Seed to Late Stage. We also deep-dive on one particular startup each week.

Author - Norman Wallace

👋 Hi, I’m Norman, welcome to our weekly newsletter. I used to work in Investment Banking at Goldman Sachs in London and now I invest debt and equity at a private capital fund. Each week I write about funding rounds across the United States.

Funding Announcements by Stage across the United States - Week Starting 06.11.2023

As the inaugrual issue of US weekly, this week’s post will act as the benchmark to assess future deal activity. As expected, deal activity in the US this week is comparable to activity across the whole of EMEA.

🤝Deal of the week: New York based Imprint raised a $75m Series B led by Ribbit Capital, with participation from Thrive Capital, Kleiner Perkins and Moore Speciality Credit.

Imprint, founded in 2020, is a payments provider which partners with brands to design, launch, and manage co-branded credit card programs that are worthy of modern customers. The company offers the key payment processing services underpinning the use of these cards, allowing merchants and consumers to complete financial transactions while also gaining loyalty and reward points.

Image credit: Imprint

Company Purpose: Imprint aims to “increase your customers’ lifetime value through more cardholders, more engagements and more insights.”

What Problem is the Company Solving?

Currently, brands face the perpetual problem of increasing customer lifetime value (LTV) whilst also keeping costs low. One way brands tackle this is by issuing branded credit cards that offer loyalty rewards with the hope of increasing customer retention. Consumers, in general, are always looking for a greater value proposition – this is truer for markets where competitive forces are greater: think value retailers. Imprint helps businesses to increase their customer LTV through a tailored rewards program – at the centre of this is a co-branded credit card. Imprint streamlines the process of creating this branded card for their customers and facilitates the payments at a competitive price for their brands.

What is the Solution?

Traditionally, exclusive branded payment choices were limited to big enterprises collaborating with established card issuers for co-branded credit cards, such as airline credit cards. However, Imprint has democratized this capability, enabling both large and small companies to swiftly create custom payment solutions—currently their co-branded cards—and personalized rewards programs in under a week. By internalizing their payment infrastructure through Imprint, businesses reduce credit card fees, allowing them to implement enticing rewards programs without incurring extra costs. Imprint strongly advise their customers to reinvest the savings that they make on processing fees into their loyalty programme, to create a stronger incentive for customers to use their card. This has the potential to create a virtuous cycle where cost savings beget better rewards which begets more revenue through this payment channel leading to…better rewards for customers. For the consumer, the value proposition is quite clear— who doesn’t like getting free stuff? It’s also important to note that the cards function like debit cards – users are not required to undergo a credit check or pay interest and fees.

Imprint state that their programs drive meaningful business impact for their partners, with brands seeing: 30%+ increase in average basket size, 12%+ increase in shopping frequency and 43%+ increase in annual sales per cardholder. These are impressive stats, especially in light of the claim that Imprint can launch a new rewards program in as little as 3 months (vs. 18 months from traditional issuers).

Another key element of Imprint’s offering is the ability to deliver insights to its customers as result of the sales linked to the rewards cards. On their website, Imprint outline 3 keys benefits of their offering:

Real time insights

Live dashboard and analytics tools to monitor program performance at any time

Data-sharing

Real-time, secure data sharing that integrates with your CRM and analytics tools

Analytics support

Dedicated support form the Imprint Analytics team to generate insights about your customers

So how does Imprint make money?

Imprint takes a cut of revenues from net interest income on the card balances and processing fees, sharing this with its bank partner, issuer First Electronic Bank and card networks like Mastercard and Visa. It also covers the cost of rewards for their brand partners.

Market Size & Competition:

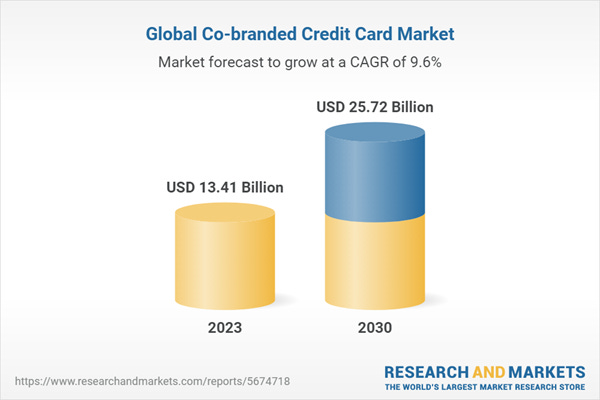

It is difficult to answer the age-old questions of what is the Total Addressable Market (TAM) and what is the Serviceble Addressable Market (SAM)? Imprint is open to working with all kinds of brands that have a dedicated customer base, regardless of industry or size. If you take this at face value, it would would mean that we are talking about a TAM that is at least the size of the global loyalty management spend. This market revolves around providing any type of solution and/or platform for businesses to create and manage customer loyalty programmes. The market was estimated to be worth $9.3bn in 2022, according to researchandmarkets.com. If you accept this figure, the applicable SAM for Imprint would be subset of this – the US global loyalty management spend in 2023. If we look at the co-branded credit card industry, we get to a TAM of $12.3bn for 2022. No matter how you slice it, both markets are anticipated to grow at 9%+ CAGR over the next 7 yrs providing good runway for growth.

Imprint’s main competition are banks. The market for co-branded credit cards is still dominated by American Express and a number of other banks including Chase, Capital One and Synchrony Bank. Imprint definitely needs more time to prove out its competitive edge, but in theory it should gain market share for a few reasons. By adopting tech-fist approach to rewards, they can offer more granular and individualised rewards than typical rewards cards that are offered by traditional banks, e.g., providing a greater % cash back on products that have a higher margin for the brands. Imprint’s software, which is built ono top of its own underwriting and ledgering system, can approve more customers as cardholders and better customise rewards. Imprint is also able to extend smaller credit lines than banks. They can gradually raise the limit after observing a customer’s payment behaviour and because it is not subject to the same regulatory capital requirements as banks, the startup should be able to deploy money a bit faster than a bank. Thrive Capital Partner, Gaurav Ahuja stated that the banks are looking at these cards as financial first products, when the reality is the best merchants and the best brands using this are looking at these as customer experience tools, marketing tools and loyalty products. As long as this remains the case, we can expect to see Imprint grow.

Team:

Imprint was founded by:

Daragh Murphy: CEO. Daragh has a background in corporate law and has worked as a corporate lawyer for WeWork, McKinsey & Company, and WilmerHale.

Gaurav Ahuja: Works as a partner at Thrive Capital. At Thrive, he focuses on fintech and SaaS across stages. Prior to working at Thrive he worked as a technology investor at TA Associates and a consultant at McKinsey.

👨💻 Job Opportunities? We also like to highlight job openings at Companies that have recently completed a funding round.

Business Development

Princeton NuEnergy - Director of Business Development (Bordentown, New Jersey. Remote)

CAST AI - Business Development Manager (US, Hybrid & Remote)

Imprint - Business Development Manager (New York, Remote)

Data & Analytics

Almond Fintech - Data Scientist (US, Remote)

Engineering

Black Ore - Engineers: Applied AI/ML, Back-End, Full-Stack, Quality Assurance & Security (Remote)

Ozone - Dev Ops Engineer (US, Remote)

Almond Fintech - Senior Mobile Engineer (South America, Remote)

Default - Frontend Software Engineer (New York)

Tidal Cyber - Engineers: Frontend, Python / Django Engineer and AWS Infrastructure (Hybrid, Reston, VA)

Ottopay - Senior Javascript Engineer (Argentina, Mexico, Remote)

Eleos Health - Senior Solution Engineer (Untied States)

Imprint - Data Engineer (New York, Remote)

Imprint - Senior Fullstack Software Engineer (Seattle, New York)

Imprint - Tech Lead, Data & ML Platform (Seattle, Remote)

Finance

Black Ore - Accountant | Tax Technology (Austin, Remote)

Imprint - Head of Capital Markets (New York)

Growth

Imprint - Director of Acquisition (New York)

Marketing

Operations

Black Ore - Business Operations (Austin, New York, Remote)

Product

Black Ore - Product Manager (Austin, New York, Remote)

Imprint - Principal Product Designer (New York, Remote)

Imprint - Technical Program Manager (Seattle, New York )

Sales

Black Ore - Acccount Management (Austin, New York, Remote)

Zuplo - Sales Development Representative (US, Remote)

Zuplo - Account Executive (US, Remote)

Almond Fintech - Partnership Sales Manager (APAC)

Strategic Finance

Black Ore - Strategic Finance (New York, Remote)

👋 Thanks again for reading, please make sure to subscribe to receive all of our weekly newsletters!